us capital gains tax news

Passed by the Senate in March in another narrow vote Engrossed Substitute Senate Bill 5096 would impose a new 7 tax on certain capital gains income including profits from selling long-term. Most long-term capital gains will see a tax rate of no more than 15 though certain assets like coins and art can be taxed at a rate up to 28.

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe

The proposal may affect a relatively small number of investors but planning now is wise.

. Rate would rise from 20 under House panels proposal. ESSB 5096 violates the uniformity and limitation requirements of article VII sections 1 and 2 of the Washington State Constitution. Long-term capital gains are taxed at lower rates than ordinary income and how much you owe depends on your annual taxable income.

Single sellers can exclude 250000 from their taxable profit and married sellers 500000. A tax on unrealized gains would harm the economy. If you sell small-business stocks or collectibles the maximum capital gains tax rate is 28.

That applies to both long- and short-term capital gains. Above that income level the rate climbs to 20 percent. Capital Gains Tax Rates for 2021.

Coupled with additional levy on high income earnings to fund the Affordable Care Act the top. Kate Stalter May 4 2021. The rates do not stop there.

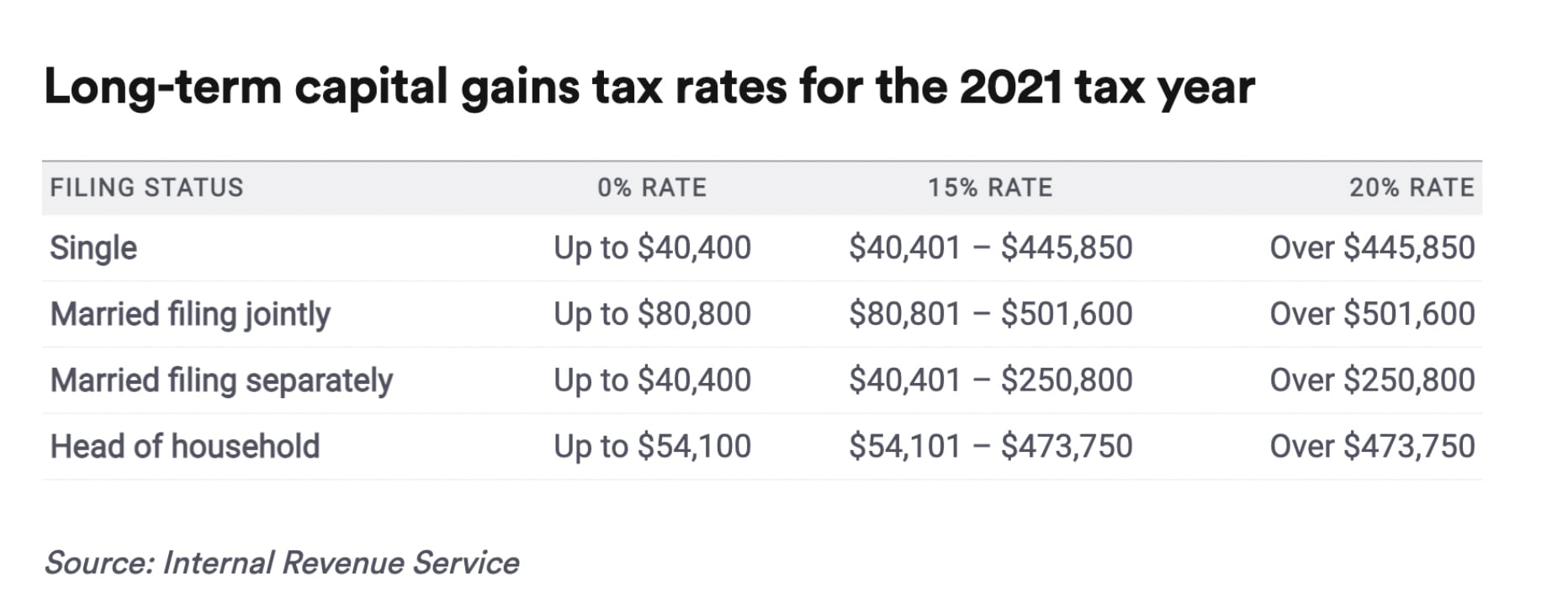

NewsNow aims to be the worlds most accurate and comprehensive Capital Gains Tax news aggregator bringing you the latest headlines automatically and continuously 247. The current long-term capital gains tax rates for single filers are 0 for taxable incomes up to 40400 15 for incomes of between 40401 and 445850 and 20 for incomes of 445851 or more. Advisors Eye Capital Gains Tax Changes.

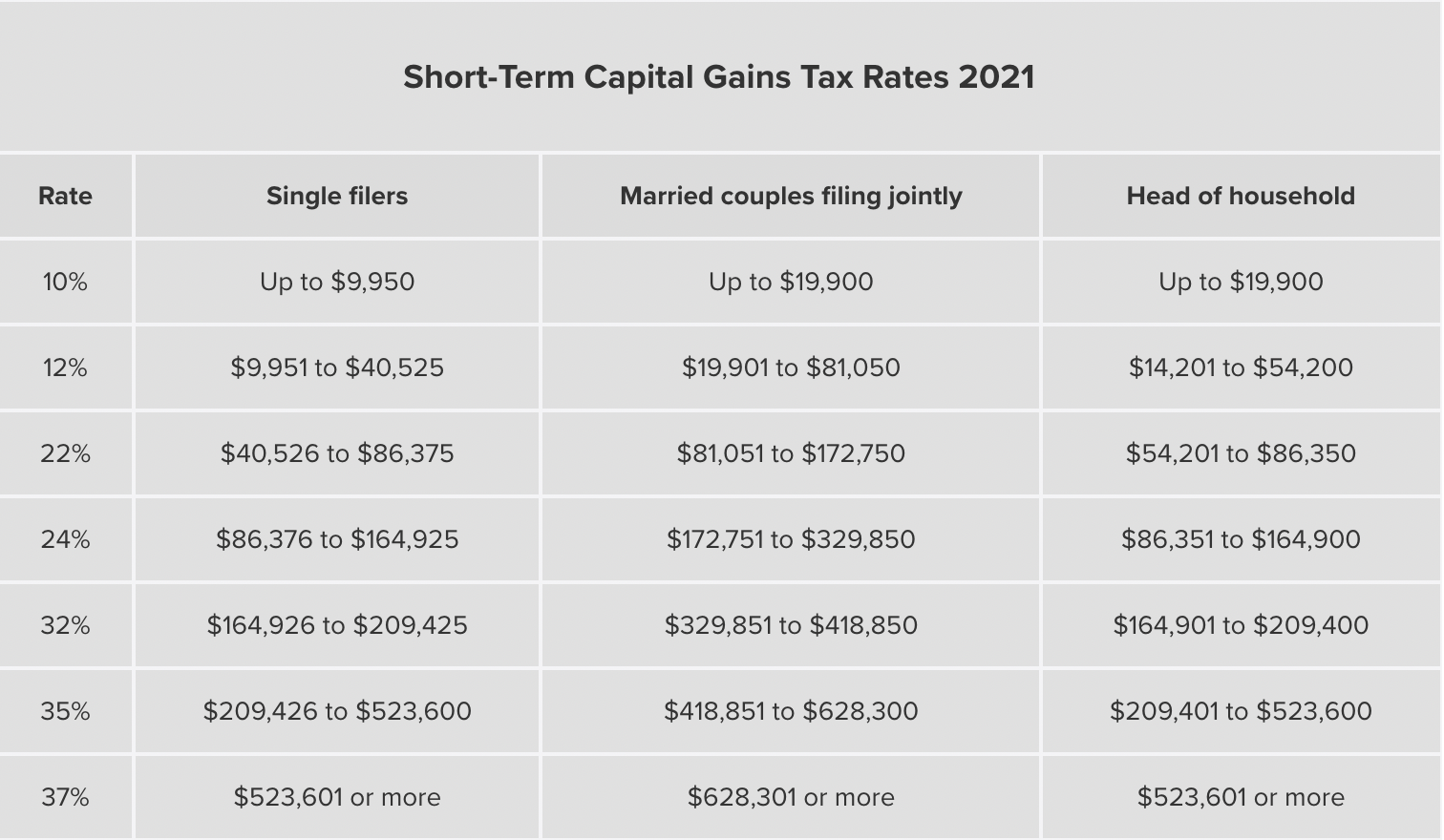

The tax rate depends on both the investors tax bracket and the amount of time the investment was held. Currently people earning more than 200000 pay a capital gains rate of about 238 including the 38 net investment tax which helps fund the. The Democrats are also proposing to add a 3.

In 2021 and 2022 the capital gains tax rates are either 0 15 or 20 on most assets held for longer than a year. Short-term gains are taxed as ordinary income. In addition those capital gains may be subject to the.

It violates the uniformity requirement by imposing a 7 tax on an individuals long-term capital gains exceeding 250000 but imposing zero tax on capital gains below that 250000 threshold. Your money adviser As Home Sale Prices Surge a Tax Bill May Follow. Short-term capital gains are taxed at the investors ordinary income tax rate and are defined as investments held for a year or less before being.

Capital Gains Tax Rate Set at 25 in House Democrats Plan. Taxpayers impacted by the tax on unrealized gains will be incentivized to move overseas in order to. NewsNow brings you the latest news from the worlds most trusted sources on Capital Gains Tax.

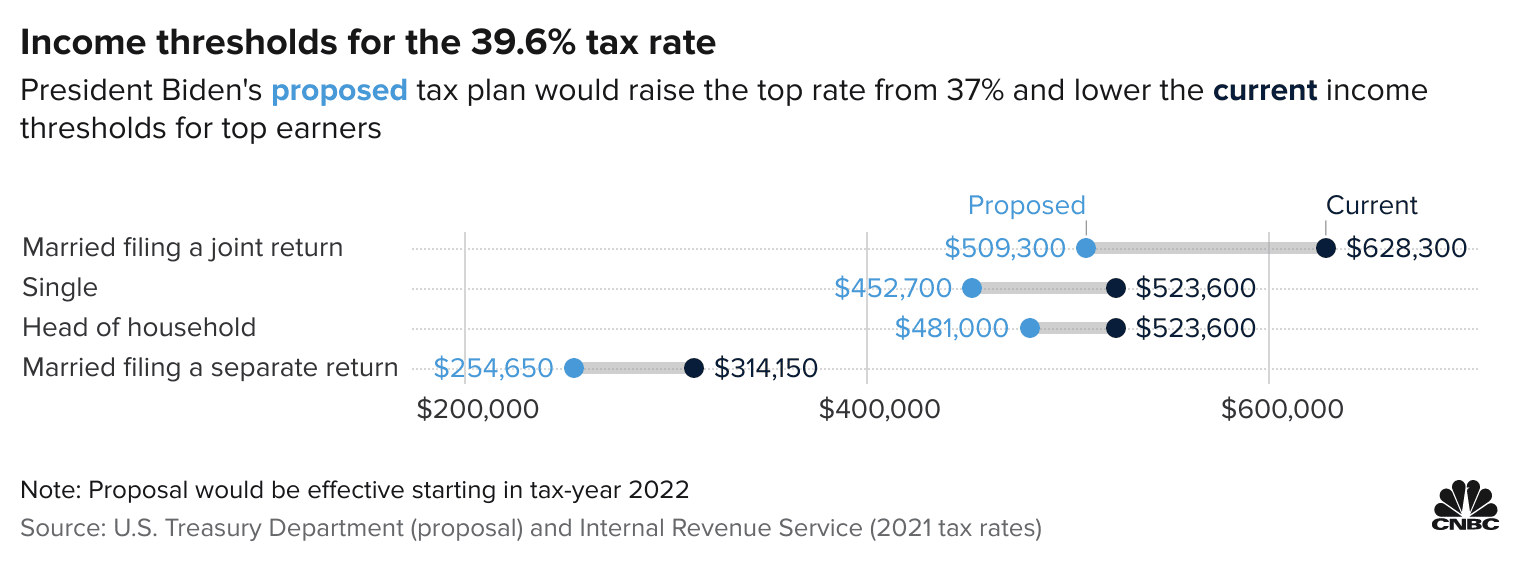

Relevance is automatically assessed so some. It has proposed to hike capital gains taxes for those earning more than 1 million annually to 396. Biden had wanted to boost rate to 396 for highest earners.

The Washington State Capital Gains Tax May Have More Than Nine Lives The Saga Continues With The State Attorney General Appealing To The Highest State Court Foster Garvey. There is currently a bill that if passed would increase the. Capital Gains Tax News.

Youll owe either 0 15 or 20. Hawaiis capital gains tax rate is 725. Capital gains tax rates on most assets held for a year or less correspond to.

Based on filing status and taxable income long-term capital gains for tax year 2021 will be taxed at 0 15 and 20. In the United States of America individuals and corporations pay US. The bottom 99 on.

The rate jumps to 15 percent on capital gains if their income is 41676 to 459750. The highest long-term capital gains rate would rise to 25 while the 38 Medicare surcharge for high-income investors would push that rate to 288. House Democrats on Monday proposed raising the top tax rate on capital gains and qualified dividends to 288 one of several tax reforms aimed at wealthy Americans to help fund a 35 trillion.

Long-Term Capital Gains Taxes. Federal income tax on the net total of all their capital gains. Under the law a capital gains tax will be levied on annual profits reaped from the sale of long-term assets such as stocks and bonds.

Depending on your income you may even qualify. The top 01 a group of just 120000 people earning an average of more than 11 million a year earned more than half of all capital gains income in the United States in 2019. The Washington State Supreme Court Renders A Decision Impacting Financial Institutions Doing Business In The State Foster Garvey.

Additionally a section 1250 gain the portion of a.

Selling Stock How Capital Gains Are Taxed The Motley Fool

How To Pay 0 Capital Gains Taxes With A Six Figure Income

Capital Gains Tax Reporting And Record Keeping Low Incomes Tax Reform Group

2021 And 2022 Capital Gains Tax Rates Forbes Advisor

A Big Mistake Joe Biden Wants To Hike Capital Gains Taxes Capital Gains Tax Germany And Italy Capital Gain

Biden Will Seek Tax Increase On Rich To Fund Child Care And Education The New York Times

Biden S Proposed 39 6 Top Tax Rate Would Apply At These Income Levels

Us Crypto Tax Guide 2022 A Complete Guide To Us Cryptocurrency Taxes

Capital Gains Tax For Individuals Not Resident In The Uk Low Incomes Tax Reform Group

Us Crypto Tax Guide 2022 A Complete Guide To Us Cryptocurrency Taxes

Can Capital Gains Push Me Into A Higher Tax Bracket

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe

Irs Tax Brackets 2022 What Are The Capital Gains Tax Rate Thresholds Marca

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)