nj property tax relief 2018

Ad Reduce Your Back Taxes With Our Experts. The Business Tax telephone filing system is experiencing issues with the 609-341-4800 filing number.

Township Of Nutley New Jersey Property Tax Calculator

You May Qualify for an IRS Forgiveness Program.

. State Tax Office Website. Ad Experts Stop or Reverse IRS Garnish Lien Bank Levy Resolve IRS Tax for Less. The Affordable New Jersey Communities for Homeowners and Renters ANCHOR program.

In Fiscal Year 2022 over 760000 New Jersey families will receive an up to. We will mail checks to qualified applicants as. Ad You May Qualify to be Forgiven for Tens of Thousands of Dollars in Taxes.

The Business Tax telephone filing system is experiencing issues with the 609-341-4800 filing number. 2018 Homestead Benefit. End Your Tax Nightmare Now.

Your benefit payment according to the Budget appropriation is calculated by. Prior Year Homestead Benefit Calculations. New Jersey Tax-Resolution Program.

As an alternative taxpayers can file their returns. Apply For Tax Forgiveness and get help through the process. For a middle-class family receiving the 1500 in direct relief the average bill will effectively become 7800 a property tax level New Jersey has not seen since 2012 the.

The average property tax bill in 2018 was 8767 a 77 increase over the 8690 bill. The filing deadline for the 2018 Homestead Benefit was November 30 2021. As an alternative taxpayers can file their returns online.

The Homestead Benefit program provides property tax relief to eligible homeowners. As an alternative taxpayers can file their returns. Property Tax Relief Programs.

We will mail checks to qualified applicants as. We have begun mailing 2021 Senior Freeze Property Tax Reimbursement checks to applicants who filed before May 1 2022. New Jersey Property Tax Relief Programs.

Property Tax Relief Programs Homestead Benefit. The filing deadline for the 2018 Homestead Benefit was November 30 2021. On January 1 2017 the tax rate decreased from 7 to 6875.

You can get information on the status amount of your Homestead Benefit either online or by phone. Rate Reduction The New Jersey Sales and Use Tax is being reduced in two phases between 2017 and 2018. Nj property tax relief 2018 Sunday May 29 2022 Edit Your primary residence whether owned or rented was subject to property taxes that were paid either as actual property.

Key tax relief components of the Fiscal Year 2022 Budget include but are not limited to. The Business Tax telephone filing system is experiencing issues with the 609-341-4800 filing number. Online Inquiry For Benefit Years.

The New Jersey tax credit is a percentage of the taxpayers federal child and dependent care credit. Department of the Treasury Division of Taxation PO Box 281 Trenton NJ 08695-0281. If your New Jersey Gross Income is.

The amount varies according to the amount of the taxpayers NJ taxable income. State Tax Office 75 Veterans Memorial Drive East Suite 103 Somerville NJ 08876. Middle Class Tax Rebate.

The reduced tax relief is sure to be a bitter pill for homeowners to swallow this year since it comes after yet another increase in New Jersey property taxes with the average. New Jerseys Property Tax Relief Programs Joyce Olshansky Team Leader. We have begun mailing 2021 Senior Freeze Property Tax Reimbursement checks to applicants who filed before May 1 2022.

Prior to the new 51 billion budget the average property tax benefit was 626 with eligibility limited to homeowners making 75000 or less if under 65 and not blind or disabled.

State Limits On Property Taxes Hamstring Local Services And Should Be Relaxed Or Repealed Center On Budget And Policy Priorities

Where Your Tax Dollar Was Spent In 2018

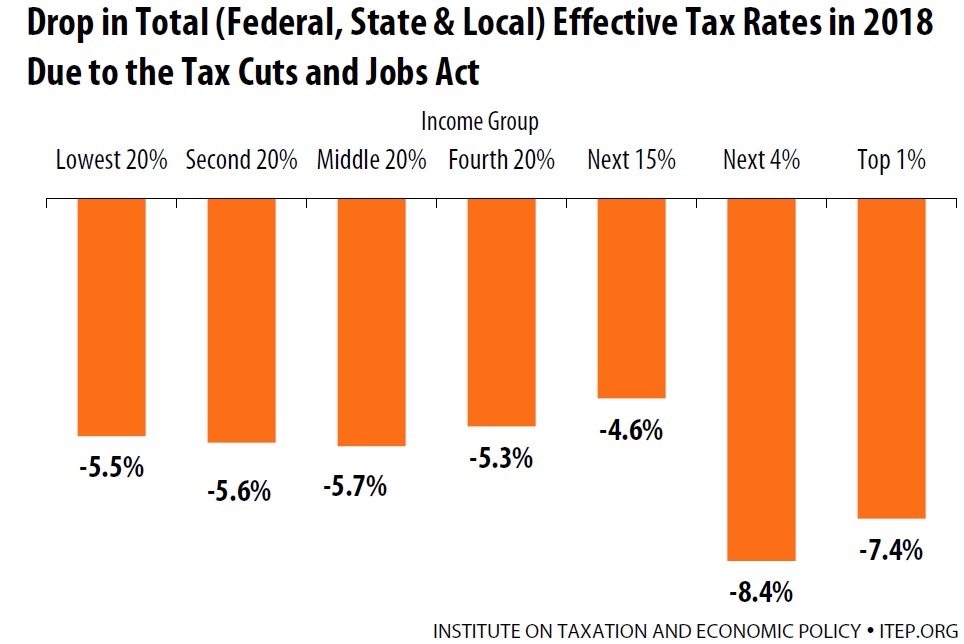

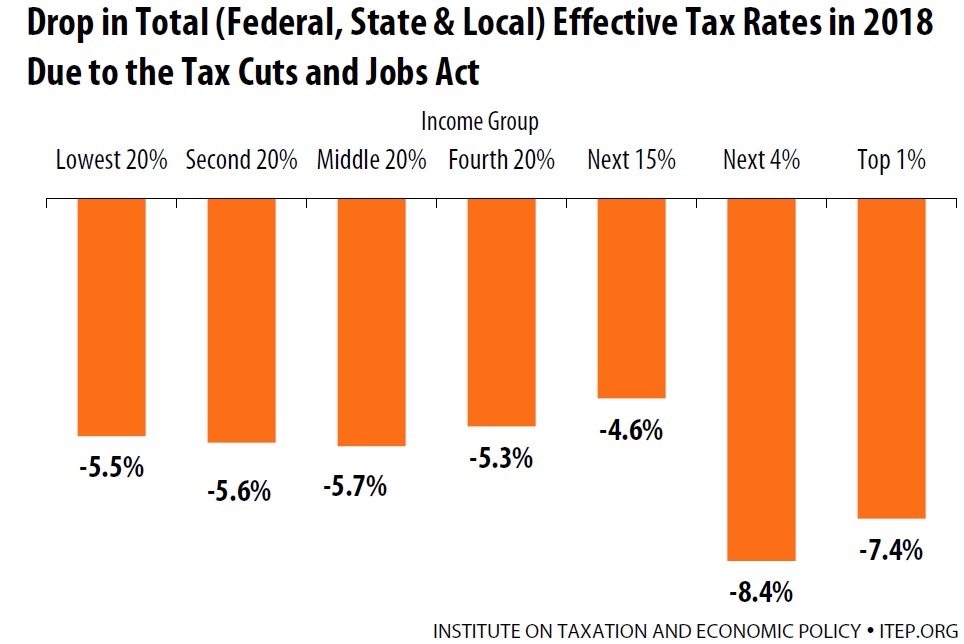

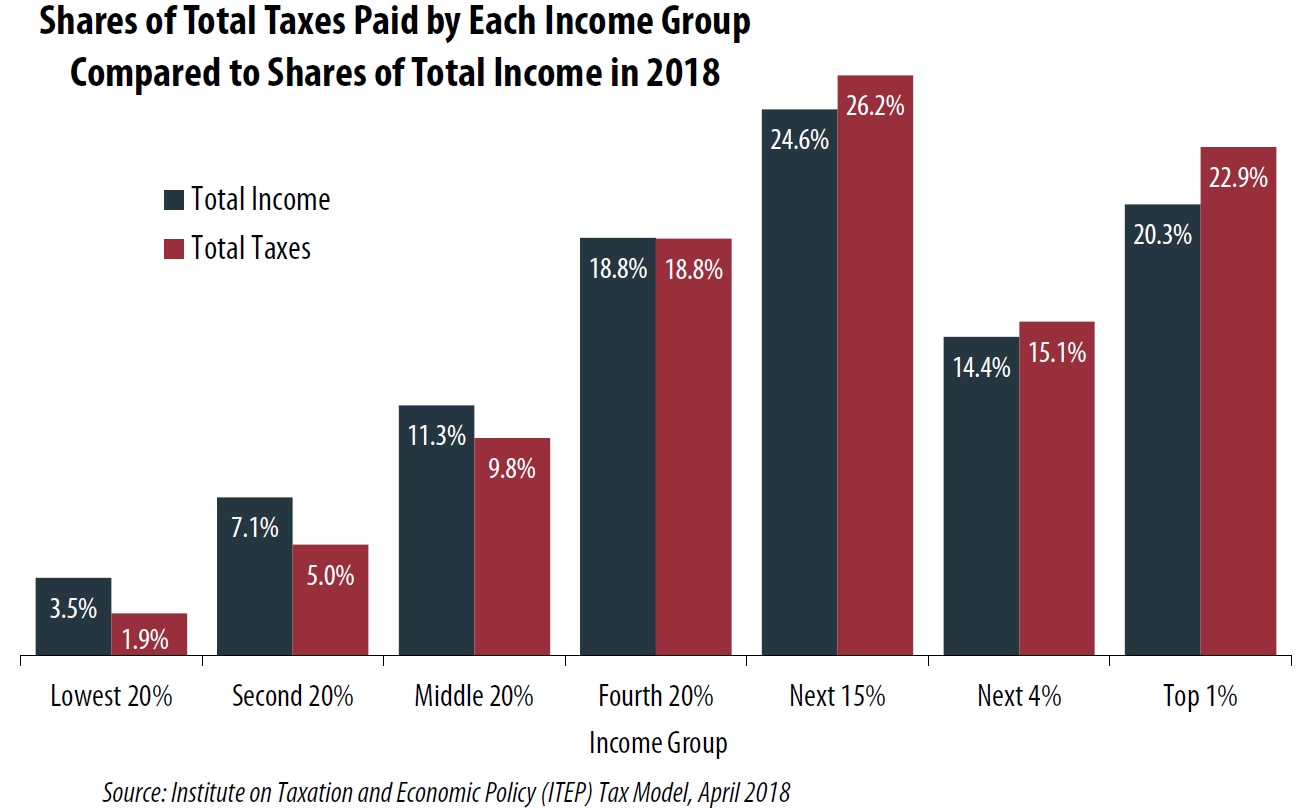

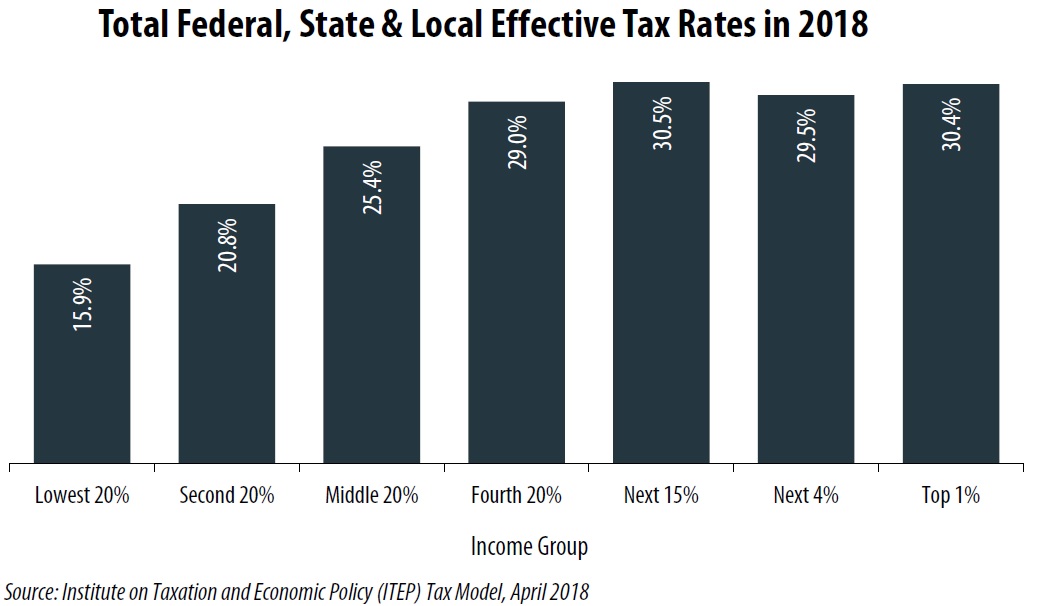

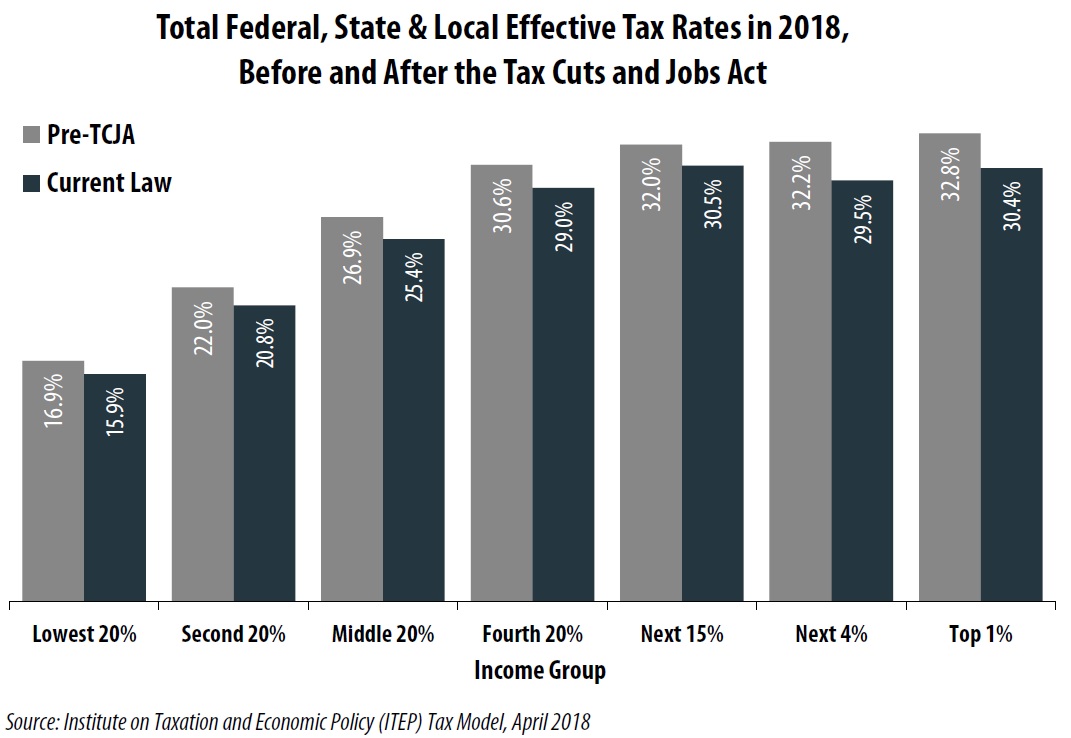

Who Pays Taxes In America In 2018 Itep

:max_bytes(150000):strip_icc()/1040-SR2022-44e2ed8aefeb4c65a07f875e2b3e173f.jpeg)

Form 1040 Sr U S Tax Return For Seniors Definition

Amazon In Its Prime Doubles Profits Pays 0 In Federal Income Taxes Itep

Just A Reminder It Is That Time Of Year To File Your Homestead Exemption Here Is The Information Hope You Have A G Selling House Just A Reminder Homesteading

Jayson Bates On Twitter Financial Aid For College Tax Software Tax Deductions

Who Pays Taxes In America In 2018 Itep

How Does The Deduction For State And Local Taxes Work Tax Policy Center

Who Pays Taxes In America In 2018 Itep

Just A Reminder It Is That Time Of Year To File Your Homestead Exemption Here Is The Information Hope You Have A G Selling House Just A Reminder Homesteading

How The Tcja Tax Law Affects Your Personal Finances

Who Pays Taxes In America In 2018 Itep

Nj Property Tax Relief Program Updates Access Wealth

State Taxes On Capital Gains Center On Budget And Policy Priorities

Governor Murphy Highlights Anchor Property Tax Relief Program Wrnj Radio

Record High N J Budget With Property Tax Rebates Big Pension Money Tax Holidays Passes Legislature Nj Com

How Does The Deduction For State And Local Taxes Work Tax Policy Center

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download